Understanding (Basic) Risk & Putting Cash to Work

A good buddy of mine recently asked me how he might invest a nice chunk of money he recently got (a work bonus).

Given that I’ve been wanting to start blogging again, I figured I’d gather my thoughts in a blog post, so others might [possibly] benefit.

SAVING VS. INVESTING

First, there’s the difference between saving and investing.

With saving, a fundamental assumption is to 1) primarily preserve principal, while 2) earning the best rate of interest possible.

The thing about about that is with reward comes risk – if you are unwilling to risk your principal, you will simply earn less. (And depending on what the money is for, and when you’ll need it, that is 100% okay.)

Next consideration – part-and-parcel with risk/reward – is when will you need the money?

Some saving vehicles offer a bit more interest-paid, but require a “lock-up” period for the money.

As one moves into the mid-point of the risk/reward spectrum, and further, there are some key variables, i.e. risks.

There’s “principal” risk: you could lose some, or all, of the money you’ve invested.

Principal risk comes when, through the ups-and-downs of the investment vehicle, it could decline in value, and isn’t there when you need it (even if it goes on to recover (and perhaps more) later). (Or it never recovers . . . .)

There’s “credit” risk, in that the value of your investment declines due to the credit quality of underlying assets declining/failing/defaulting (usually in bond funds).

There’s “interest rate” risk: your could lose money due to changes in interest rates (this was acute during the recent Fed rate-hike-cycle).

So, those are three primary risks, a few of the different ways one could lose money.

What are the actual ways one could save or invest a chunk of money?

THE NITTY GRITTY

Let’s go through some actual saving/investing options, keeping in mind my buddy won’t need the money for approximately five years.

First, there’s the safest: a high-yield savings account (HYSA).

These are pretty attractive right now, paying between 4.3% and ~5%. Of course, as The Fed cuts rates (and it will at some point… ), these rates will go down.

Next are “no-penalty certificates of deposit,” which are basically “all-or-nothing” HYSAs – meaning, you can earn a bit more than a HYSA, take your money out whenever you want, but you have to empty the account (i.e. no partial withdrawals). The problem with these is that the maximum term is approximately 15 months – meaning, there’s a form of interest rate risk (re-investment risk: once those 15 months are up, new CD rates will (likely) be lower).

There are regular Certificates of Deposit where your money is guaranteed a particular rate, but locked up for the stated term. For longer terms CDs (48-months-plus), we’re looking at low 4s for rates.

Then there’s Brokered CDs, individual Treasuries and Bonds.

Right now you can lock up 3.95% on a 5-year Treasury. But it’s not liquid. Yes, you can sell it on the secondary market (before five years), but there’s a real possibility you could lose money doing so.

I looked at various individual bonds (Agency, Municipal and Corporate) and either the minimums are too high or the bonds are callable after a year or two.

Unless I’m missing something (entirely possible!), we’re left with individual stocks, stock funds and bond funds.

I’m not one to invest in individual stocks – EVER (again… ) (what’s more, individual stocks are not appropriate for the time frame) – so we’re left with stock and bond mutual funds and Exchange Traded Funds (ETFs). [Assuming sufficient liquidity, I go with ETFs for these sorts of things.]

Before I get into what I would do, at this point in time, with a nice windfall, let me show you what I’m doing right now with my non-retirement money.

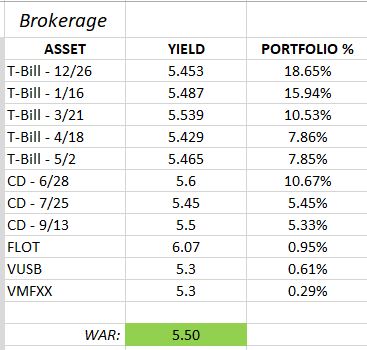

Here’s a screen-shot of Weighted Average Return of my (Vanguard) Brokerage account:

Some nice yields there, but it’s all pretty short-term stuff.

And, a couple of those CDs are callable… so, while I won’t lose money if they’re “called” by the bank, I won’t earn that sweet interest rate for the entire CD term.

So, I’ll be making some choices in mid-to-late 2024 on how to re-deploy these funds (and I can already hear myself: “Man, it was fun while it lasted… “).

But enough about me, what about my buddy and what might he do with that block of cheddar?

If it were me – and that’s all I can say, as I’m not a financial professional, and nothing I say should be considered financial advice – here what’s I would do:

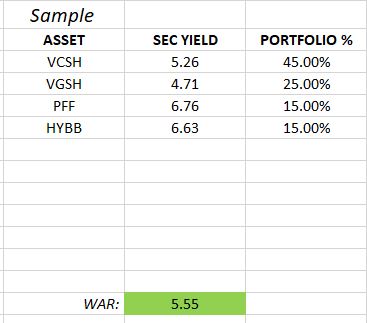

A couple flavors of investment-grade, short-term bonds (45/25%) – and a couple kickers: some preferreds (15%) and some (decent) high-yield (15%).

AND, I would review the investments every quarter in the 18 months preceding when I might need the money.

Meaning: once I were 18 months out from needing the money, I would take stock of the “portfolio” and if it were up, I would de-risk and move the preferreds and high-yield into something safer. If those funds were down, I would monitor them each quarter and sell once they recovered.

What funds would I use [and what are their 30-day SEC Yields]?

VCSH – Vanguard Short-Term Corporate Bond ETF [5.26%]

VGSH – Vanguard Short-Term Treasury ETF [4.71%]

PFF – iShares Preferred and Income Securities ETF [6.76%]

HYBB – iShares BB Rated Corporate Bond ETF [6.63%]

VCSH – 45% – is a solid short-term, investment-grade, corporate bond fund – and pays monthly dividends.

VGSH – 25% – is a solid short-term, Treasuries bond fund – and pays monthly dividends.

PFF – 15% – allows exposure to Preferred Shares (which are kinda like corporate bonds, but pay more in yield, for a slight bit more risk) – and pays monthly dividends.

HYBB – 15% – gets into the best quality “junk” bonds. I know that’s a contradiction of sorts, but it only invests in the highest rated (BB) high-yield corporate bonds – and pays monthly dividends.

Here’s an illustration of the Weighted Average Return (based on 30-Day SEC Yield on 12/26/2023):

So there ya have it: some thoughts on saving vs. investing and what I would do if I were investing on a ~5 year time horizon (at the start of 2024).

One final note/caveat: the recession that so many called for in 2023 never happened. It could well happen in 2024, and PFF and HYBB could get beat up a bit, but I don’t think they’ll get creamed . . . . The Fed and the US Gov’t has shown, again and again, that they just won’t let the US Economy fall, too far. Will future generations pay a steep price for that? Absolutely. Will this ‘portfolio’ do well over the next five-or-so years? Yeah, I’m pretty darned sure it will.

Am I off-my-rocker or nailing it? Send me a note if you’ve got thoughts.